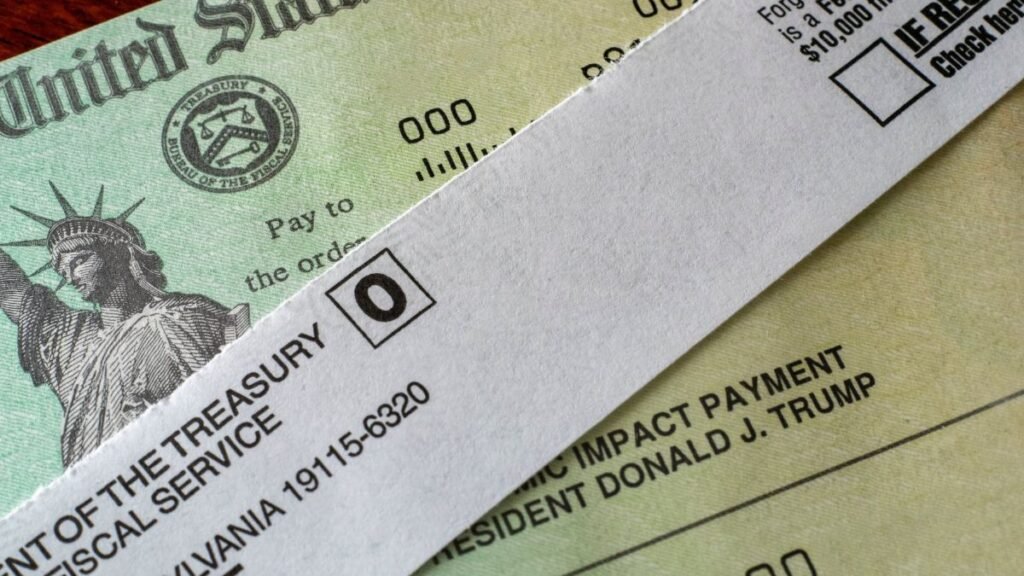

Fact-check reports by the IRS and major US media outlets clearly state that no new federal stimulus checks or relief payments have been authorized in November 2025. Congress has not passed any new legislation, and the IRS has not confirmed any such plans.

The reason for so much discussion is former President Donald Trump’s proposal to distribute government revenue from the economy’s recovery and tariffs as a “dividend” among the public. He stated that this amount of “at least $2,000” would go to middle-class and low-income working families. However, this is only a potential plan, not a confirmed government policy.

Cause of Confusion and the Danger of Fake Messages

During the COVID-19 pandemic, several federal stimulus checks were received in the United States. This nostalgia, combined with viral posts on social media, has fueled the confusion that a new stimulus plan may have been implemented again.

Trump’s post on Truth Social—”A dividend of $2,000 per person (excluding high-income earners) will be paid“—further fueled this confusion.

In this environment, numerous scam emails and fake text messages are also going viral, asking for bank or Social Security details. The IRS has clarified that it never makes such contacts and that citizens should disregard any such messages.

Trump’s ‘Tariff Dividend’ Plan—What’s the Reality?

- The Trump administration proposed distributing a portion of the revenue generated from tariffs (duties on foreign goods) directly to individuals.

- The estimated cost of the plan would be $400–$600 billion, while current tariff revenues are significantly lower—approximately $200 billion in 2025.

- The ‘Dividend’ plan, if approved by voting and legislation, could be implemented only in mid-2026 or later.

- Treasury Secretary Scott Bessent and Trump himself both stated that “we need congressional approval for this.”

- There will be an income limit, meaning high-income earners will be excluded, but no specific limit has been announced yet.

This amount could also be provided indirectly in the form of a tax break or rebate.

What should citizens do?

- The IRS advises that any email, call, or message containing a “stimulus” or “tariff check” should be immediately verified.

- Only trust official sources like IRS.gov or the U.S. Treasury Department’s website.

- Never provide any bank, Social Security, or personal information by following a link.

- Keep your tax filings on time and up-to-date to remain eligible for any new or updated relief programs in the future.

- If a message insists on “Register immediately” or “Claim this link,” it’s almost certainly a scam.

Monitoring and the Way Forward

Despite unprecedented tariff revenue and election-year pressure, this plan remains merely an idea, and enacting legislation, legal review, and securing sufficient financial resources to implement it remain significant challenges. Industry experts and economists are debating whether such payments, whether directly by check or as a subsidy, could have long-term impacts on the domestic market, inflation, and the government’s budgetary situation.

Conclusion: Avoid confusion; trust official information only.

Currently, no federal Trump stimulus checks for November 2025 have been approved or issued. This is merely a political proposal, and legal implementation will take time and process.

It is most important for citizens to be cautious of fake messages and rumors, seek information only from official government portals, and keep their financial documents updated regularly—so that they can avail themselves of the benefits of any genuine relief scheme in the near future in a timely manner.

FAQs

Q. What is Trump’s $2,000 tariff dividend proposal?

A. It is a plan to return money from U.S. tariff revenue to most American citizens as a “dividend” payment of at least $2,000, mainly targeting middle- and low-income earners.

Q. Is the $2,000 dividend payment approved or active yet?

A. No. The plan is a proposal only—Congress has not passed any legislation, and Treasury/IRS has not confirmed any payment schedule or eligibility.

Q. How would Americans receive the dividend if implemented?

A. Potentially, the benefit could come as a tax cut, tax credit, refund, or direct check. Treasury officials indicate tax relief is more likely than a physical check.

Q. Who would be eligible for the payment?

A. The proposed plan excludes high-income earners. Official income thresholds and detailed eligibility have not yet been announced, but it is aimed at working- and middle-class families.

Q. What should Americans do now?

A. Wait for official updates from the U.S. Treasury or IRS.gov. There is no need to apply, enroll, or provide personal information to unofficial sources or websites.